By Mahlon Meyer

Northwest Asian Weekly

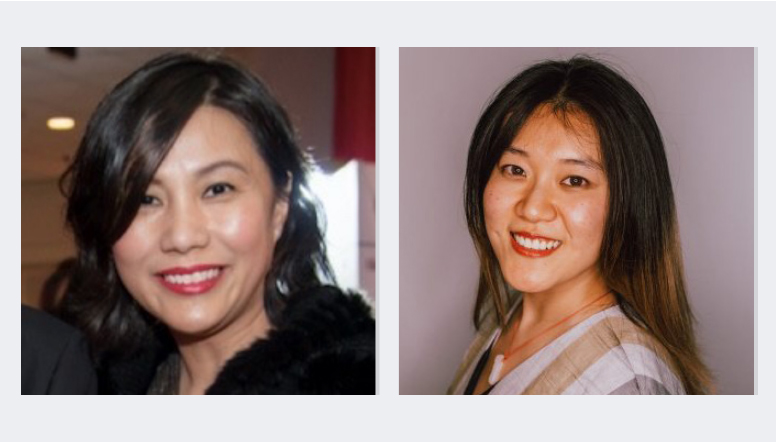

Cecilia Yap (left) and Shirley Xu (right), two HUD-certified housing counselors recently hired by Parkview Services. (Courtesy of Parkview Services)

Asian Americans and Pacific Islanders (AAPIs) are facing housing emergencies both as renters and as homeowners, according to agencies that provide support.

Reasons for the crisis, which has exploded over the last several years, include burgeoning housing prices, the increasing scarcity of affordable housing, cultural barriers, and the continuation of redlining, albeit in a different form.

Social service providers predict the expiration of federal moratoriums on evictions and foreclosures, coupled with the end of certain Covid-related social security benefits, will cause a “landslide” of housing disasters for AAPIs.

“Due to the limited supply of public housing, a lot of our clients are renting from individual homeowners,” said Karia Wong, Family Resource Coordinator at Chinese Information and Service Center (CISC). CISC helps immigrants apply for housing. It also provides information to seniors and families for housing information and assistance.

“During the past 18 months, housing markets are skyrocketing upwards across the country, including most of the popular communities for AAPI immigrants. As a result, there is an increasing number of AAPI renters who need to look for housing because their landlords have decided to sell their properties for greater profits,” said Wong.

Parkview Services is the largest nonprofit in the state and one of three agencies in King County that is authorized by the Department of Housing and Urban Development (HUD) to help homeowners facing foreclosure. They provide one-on-one assistance and work with lenders to modify their loans.

Loren Shekell, mortgage default manager, recently hired two Chinese mortgage counselors as a response to the growing demand for AAPI services. Since 2018, the need for Chinese and Korean interpreters has surpassed that for Spanish, said Shekell.

But she found that the intricacies of explaining foreclosures and how to work with banks to interpreters took an inordinate amount of time, and oftentimes the interpretation would still be faulty.

Shekell consulted with CISC who told her that it was harder for AAPI homeowners to trust someone who didn’t speak their language or come from their culture.

“They would often prefer to go to a family member,” she said.

So she made the decision to hire AAPI mortgage counselors and train them, understanding that it takes about a year to master the job.

Her first hire, a Korean mortgage counselor, was so popular that she soon had 65 clients. Now one third of her team of counselors is AAPI.

Their work mostly involves hammering out deals with banks so that homeowners can keep their dwellings, often through extending the repayment term or lowering the interest rate. In some cases, they find rescue grants or loans for their clients.

They sometimes work with a client for over a year and a half to find a solution.

With the expiration of the federal moratorium on evictions and foreclosures and the end to Covid-related unemployment relief, Shekell is expecting a landslide of new cases on top of the current increase.

The recent flurry of AAPIs needing housing assistance underscores the continuing inequities that forestall homeownership by marginalized groups in the first place.

Historically, marginalized communities were denied mortgages throughout the 20th century. A particularly grievous example occurred after World War II when the GI Bill promised mortgages to all veterans but ended up stealing the taxes of veterans of color in order to subsidize mortgages for white veterans, helping to build a white middle class, according to the book, “When Affirmative Action was White,” by Columbia University professor Ira Katznelson.

Such disparities are exacerbated by the massive increase in housing prices in the Seattle area—which was over 14% this last year, according to Zillow.

One client of Parkview, who asked for anonymity, recently obtained a rescue loan, allowing her to save her condo from a surprise special assessment. She said she felt she was being targeted by her HOA to force her to sell.

The condo is near a new light rail station that is fueling a massive increase in housing prices.

The rise in housing prices is also forcing immigrants out of their accustomed neighborhoods.

“Since immigrants tend to stay in the communities they are familiar with, it becomes more and more challenging for them to remain in those same communities where they have a sense of belonging,” said Wong.

Another underlying factor to the crisis is the lack of affordable housing, say social service agencies, which leaves AAPI clients, particularly immigrants, desperate when they need it the most.

“The biggest housing challenge for immigrants is lack of immediate affordable housing when people need it the most,” said Wong. “The average wait time for public housing varies from a few years to over 15 years, depending on the location. In addition, with the average home price in the area, it becomes an almost-mission-impossible for our clients to purchase a home in their ideal communities.”

Cultural barriers also contribute to housing problems.

Shekell said that some small Asian businesses she has encountered have never done a profit and loss statement.

Then, when they find themselves confronting foreclosure from a bank, it becomes difficult to play catch up.

Just speaking a different language or not knowing the credit system can make it difficult for immigrants to get home loans, said Wong.

As a result of such barriers, particularly the lack of affordable housing, immigrants and other AAPIs often find themselves trapped in desperate situations, such as domestic violence.

“Because of the shortage of public or affordable housing, there has been an increase in domestic violence, so there are quite a few victims we serve that are forced to stay with their families or friends,” said Wong.

For general housing assistance, contact CISC at: 206-624-5633 or info@cisc-seattle.org.

If you are struggling making your mortgage payments or need guidance coming out of your forbearance program, contact one of Parkview’s HUD-certified housing counselors at 206-542-6644 or go to https://bit.ly/38OevRx.

Mahlon can be contacted at info@nwaweekly.com.